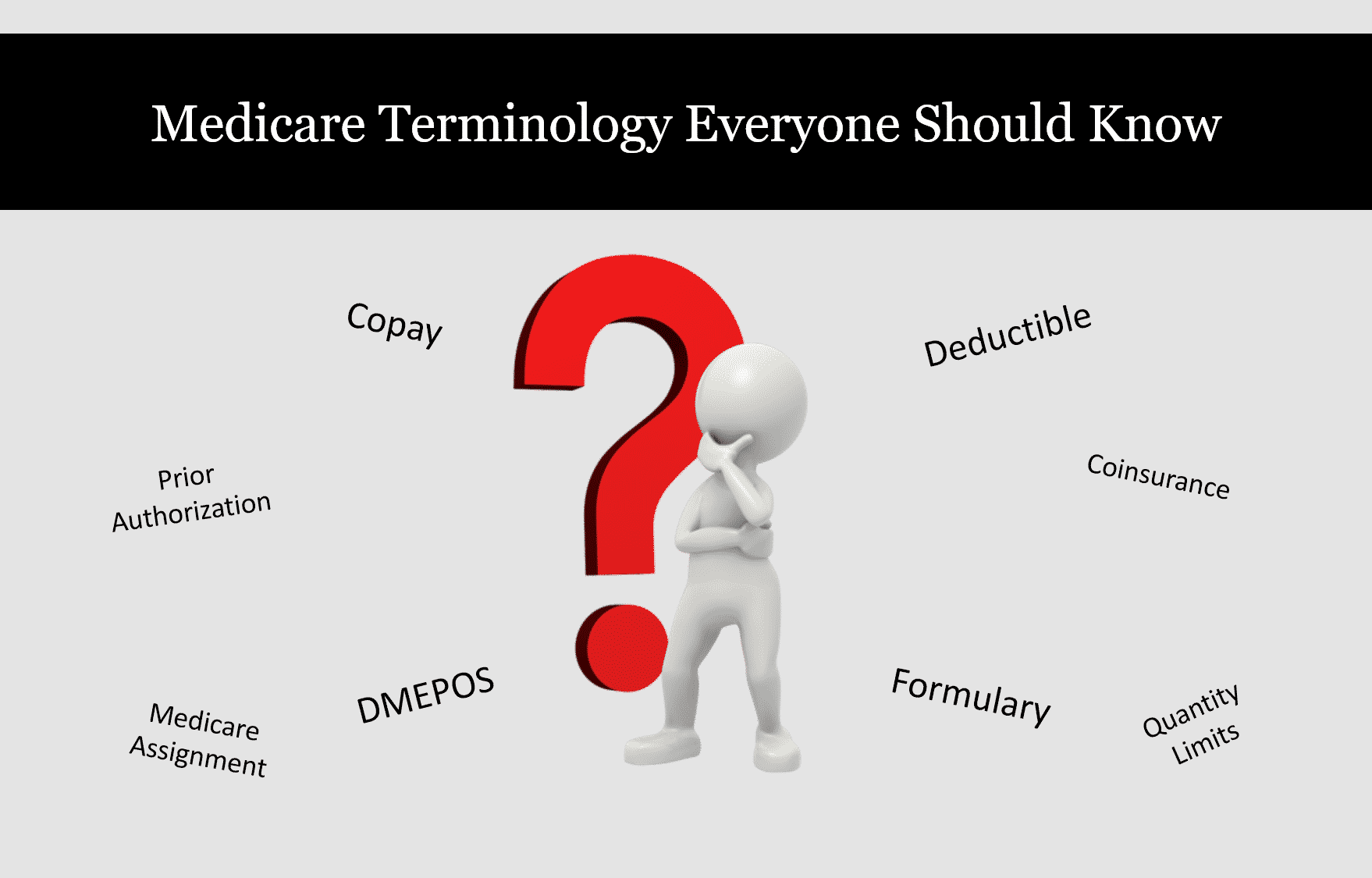

Most people have more exciting things to think about other than healthcare terminology. But having a basic understanding of common healthcare terms and language can be very helpful. Here we explain the commonly used Medicare terms to help you stay informed about your healthcare plan.

Difference Between Copay and Deductible

One way to think of the difference is that deductibles are “upfront” and copays (and coinsurance) are “pay as you go.” For example, if your Medicare plan has an annual medical deductible of $400, that means you would pay the full cost of any medical services until you have paid $400. Then you would be done paying the annual deductible for the whole year. Copays are a preset, fixed amount that you owe every time. For example, if a specialist visit has a $35 copay, you pay $35 every time you see a specialist.

Medicare Assignment Amount

If your doctor accepts Medicare assignment, they are agreeing to take payment of the Medicare-approved amount as payment in full for a service. For example, if your physician normally charges $200 for a specific procedure, but he/she accepts Medicare Assignment at $150, then your physician cannot charge you more than $150 for that procedure.

DMEPOS Provider

DMEPOS stands for Durable Medical Equipment, Prosthetics, Orthotics, and Supplies. Generally, the term refers to physical objects which can be prescribed (yes, you can write a prescription for a wheelchair or a hospital bed), but it can also refer to things such as diabetic supplies.

Formularies and Drug Restrictions

A formulary is the list of drugs covered by your Medicare Part D plan. You should always make sure that any medications you currently use are included in the plan’s formulary. However, sometimes when you try to use your Medicare Part D plan, the pharmacist will tell you that the medication is not approved, even when you know it’s on your plan’s formulary.

This is because Part D plans sometimes put additional restrictions on particular drugs, especially if they are expensive and/or can be substituted for a lower-priced alternative. The most common restriction is “prior authorization.” This means that your doctor needs to get approval from the plan before the plan will pay for a certain drug. Another common restriction is “quantity limits”, where the plan will cover a certain amount of drugs for a certain number of days to ensure safe and effective use of the drug.

In all of these cases, you may file an appeal with Medicare and your plan if you believe the regulations should not apply in your particular case.