Are Medicare premiums tax deductible? As responsible citizens, we all aim to minimize our tax payments while remaining compliant with the law. With tax preparation for the previous year is here. Subsequently, you may be wondering if your Medicare premiums can be used as a tax deduction.

In this article, we will explore the question, “Are Medicare premiums tax deductible?”. This guide will help you on how to effectively utilize your Medicare premiums as a tax deduction.

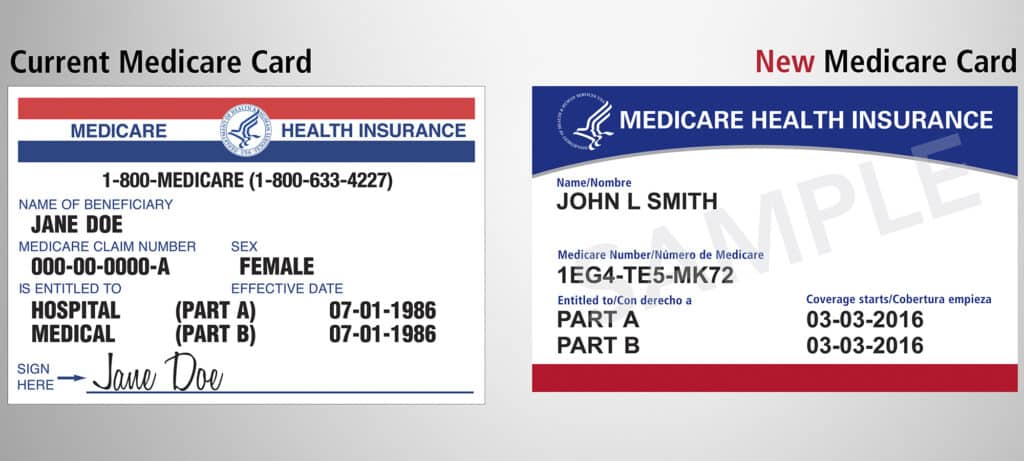

What is Medicare?

As a senior citizen, you may be eligible for Medicare, the federal health insurance program for individuals 65 years and older. Medicare helps cover the cost of medical expenses, including hospital stays, doctor visits, and prescription drugs.

If you are paying for Medicare, you may be wondering if you can deduct the premiums from your taxes. In this article, we will discuss whether Medicare premiums are tax-deductible and how the deduction works.

Itemize Your Taxes Or Take The Standard Deduction

To determine if your Medicare premiums and expenses are tax-deductible, you must choose between the standard deduction and itemization.

The standard deduction is a fixed dollar amount regardless of actual expenses. Furthermore, the amout varies based on factors such as filing status and age.

Opting for the standard deduction eliminates the need to itemize deductions, saving you time and effort. On the other hand, itemizing involves listing eligible expenses to be deducted from your taxes.

How To Decide On The Right Deduction Type?

When considering if itemizing deductions is better than the standard deduction, you must determine if your itemized deductions will exceed the standard amount. If your itemized deductions are higher, it may make sense to itemize, including deductions for your Medicare expenses.

According to the IRS, there are two options for taking deductions on your federal income tax returns:

- Itemize your deductions

- Use the standard deduction.

The standard deduction amount may vary based on income, age, blindness, and filing status and changes each year. Some taxpayers are forced to itemize and cannot use the standard deduction. This includes:

- Married individuals filing separately whose spouse itemizes.

- Individuals who file a tax return for a period less than 12 months due to a change in accounting period.

- Non-resident aliens or dual status aliens during the year.

- Estate, trusts, common trust funds, and partnerships.

On the other hand, a non-resident alien married to a U.S. citizen or resident alien who chooses to be treated as a U.S. resident for tax purposes can take the standard deduction.

If you can itemize, you may reduce your taxes by doing so on Schedule A. Schedule A includes items such as state and local taxes, real estate taxes, mortgage interest, and gifts to charities. You may also include amounts paid for medical and dental expenses.

This information is not tax advice. Consult a tax professional for tax related questions.

Are Medicare Premiums Tax Deductible?

The short answer is yes, Medicare premiums can be tax-deductible. However, the amount you can deduct depends on your income and tax filing status.

The IRS allows you to deduct medical and dental expenses that exceed 7.5% of your adjusted gross income on form 1040 or 1040 senior. This includes insurance premiums for medical and dental care, including premiums for qualified long-term care insurance contracts (details in IRS Pub 502), prescription medicines, chiropractic care, dentist, medical doctor, lab fees, and Medicare Part B premium (most are $164.90 this year, but higher income individuals may pay more).

The deductions listed in the 2022 Instructions for Schedule A.

How Does the Deduction Work?

To deduct Medicare premiums, you must itemize your deductions on your tax return. This means that you cannot take the standard deduction, and instead must list all of your deductions, including mortgage interest, charitable donations, and medical expenses.

The medical expenses that are tax-deductible include Medicare premiums, as well as other medical expenses that exceed 7.5% of your adjusted gross income.

For example, if your adjusted gross income is $50,000 and you have $4,000 in medical expenses, including Medicare premiums, you can deduct $1,500 ($4,000 – ($50,000 x 7.5%)).

What about the Part D Premiums? Are They Deductible?

You can itemize and deduct premiums you paid for your Medicare Part D insurance, which is your drug plan. You can also deduct expenses for smoking cessation programs and prescription medications for nicotine withdrawal. When a doctor diagnoses obesity as a disease, expenses for weight loss programs related to that disease are deductible.

This includes medical treatment for drug or alcohol addiction, medical aids such as eyeglasses, contacts, hearing aids, braces, crutches, wheelchairs, and guide dogs, including maintenance costs. Surgery to improve vision, such as laser eye surgery or radio keratominy, can also be deducted.

If you travel for medical care, you can deduct lodging expenses, ambulance services, and other travel costs, including gas, oil, parking, and tolls if you use your own car.

The cost of breast pumps and supplies that assist lactation are deductible. Additionally, personal protective equipment like masks and hand sanitizer, can also be claimed if used primarily to prevent the spread of coronavirus.

However, expenses for diet food, cosmetic surgery not related to a congenital abnormality, injury from an accident or trauma, or disfiguring disease cannot be deducted.

Limitations

There are limitations to the deduction for Medicare premiums. For example, you cannot deduct your Medicare Premiums when covered by your employer. Additionally, if your income is too high, you may not be able to deduct all of your Medicare premiums.

Non Deductible Expenses:

- Life insurance or income protection policies

- The Medicare tax on wages (2.90% split between employer and employee, or fully paid by self-employed individuals)

- Nursing care for a healthy baby

- Imported drugs that are not approved by the U.S.D.A.

- FDA, non-prescription medications for general health purposes

- Travel for rest or a change of scenery, funeral or cremation costs

You can deduct medical and dental expenses for yourself, your spouse, and any dependents you plan to claim on your tax return.

Conclusion

In conclusion, Medicare premiums can be tax-deductible, but the amount you can deduct depends on your income and tax filing status. To take advantage of this deduction, you must itemize your deductions on your tax return and have medical expenses, including Medicare premiums, that exceed 7.5% of your adjusted gross income.

This article is not tax advice. Consult a fiduciary investment advisor or tax specialist for tax questions.