Medicare Part A: Hospital Insurance

Medicare Part A is sometimes referred to as ‘hospital insurance’ and provides help with the cost of inpatient services, such as:

- inpatient hospital stays

- skilled nursing services

- home health care

- and hospice care

For most people, Medicare Part A comes with no monthly premium as long as you or your spouse have contributed payroll taxes to Medicare for at least 10 years. Part A benefits are automatic for individuals covered by Social Security.

However, Part A does not cover all of your hospital costs – as there are exclusions and out-of-pocket costs you are responsible for (i.e. hospital deductible and co-payments, private-duty nursing, comfort or convenience items, etc.).

How Much Does Part A Cost?

Typically, Medicare Part A comes with no monthly premium as long as you or your spouse have made payroll contributions for at least 10 years. However, if you need to buy Part A, you will pay up to $413 each month in 2017.

What Does Part A Cover?

Medicare Part A provides help with the following:

- a semi-private hospital room

- your hospital meals

- skilled nursing services

- care on special units, such as intensive care

- drugs, medical supplies, and medical equipment as an inpatient

- operating room and recovery room services

- all but the first 3 pints of blood

- rehabilitation services, such as physical therapy received through home health care

- care to manage symptoms and control pain for the terminally ill (hospice care)

Note: all Medicare Advantage (Part C) plans must also cover these services. Costs may vary by plan and may be either higher or lower than those in Original Medicare. It is very important to review your plan each year to ensure you are aware of any changes in cost.

How Do I Sign Up for Part A?

If you are receiving Social Security benefits when you turn 65 or otherwise become eligible for Medicare, you should automatically be enrolled in Part A (and Part B). It is always best to check with your local Social Security office if you suspect there is a problem.

If you are not receiving Social Security benefits when you turn 65 or otherwise become eligible for Medicare, you can sign up for Part A at your local Social Security office or online.

Click here to find your local Social Security office

Click here to apply for Medicare Part A online

When Can I Sign Up for Part A?

Initial Enrollment Period

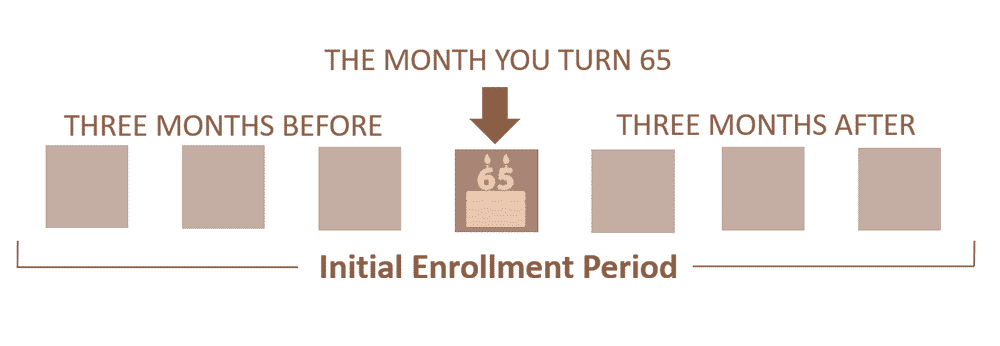

The 3 months before your 65th birthday, the month of, and the 3 months after

IEP: Initial Enrollment Period

Your initial enrollment period (IEP) is your first chance to enroll in Medicare Part A (and Part B). IEP includes the 3 months before, the month of, and the 3 months after the month of your 65th birthday (giving you a 7-month window).

- If you enroll before the month you turn 65, coverage starts on the first day of your birthday month.

- If you enroll during your birthday month or later, coverage starts on the first day of the month following the date you enroll.

General Enrollment Period

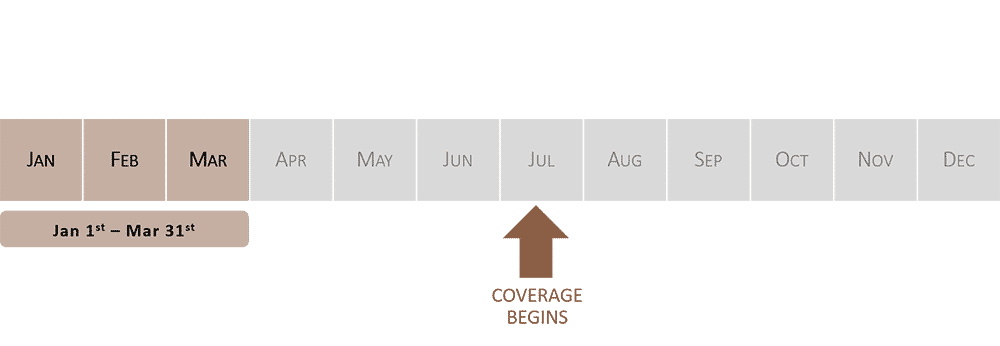

Every year between January 1 – March 31

GEP: General Enrollment Period

If you do not sign up for Medicare Part A during your IEP, you will need to wait for the general enrollment period (GEP), which occurs every year from January 1 – March 31. During this time you may enroll in Medicare Part A (and Part B) and coverage will take effect July 1.

Special Enrollment Period

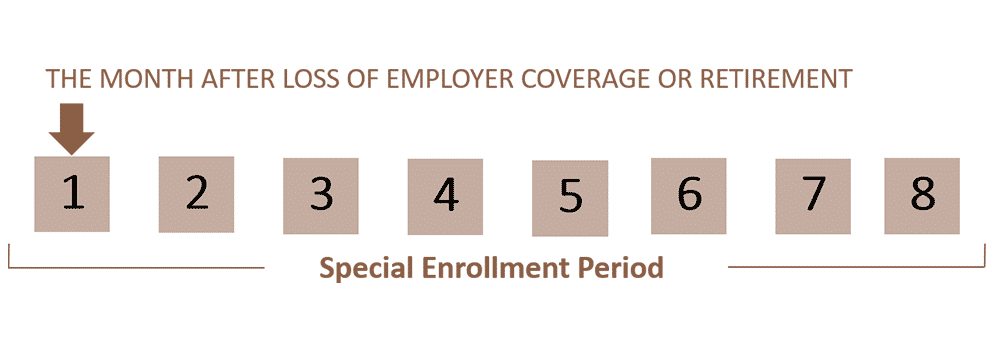

Up to 8 months to enroll in Part A (and Part B)

SEP: Special Enrollment Period

A special enrollment period (SEP) allows you to enroll in Medicare Part A (and Part B) outside of IEP or GEP if certain specific circumstances apply to you. For example: if you were working past age 65 and were covered on an employer or union group plan, then later lost that coverage due to retirement or loss of employment. During a SEP you are given an 8-month window (beginning with loss of employer group coverage) in which you can enroll in Medicare Part A (and Part B).

Which Doctors Can I See?

You can choose any doctor or provider in the United States who accepts Medicare. Since Part A offers the same benefits throughout the United States, you are not limited to a particular state or region for your care.

Are Prescription Drugs Covered Under Part A?

With a few exceptions, most prescriptions are not covered by Medicare Part A. You can add drug coverage by enrolling in either a Medicare Advantage Plan (Part C) or a Medicare Prescription Drug Plan (Part D).

Do I Need a Primary Care Doctor or a Referral to See a Specialist With Part A?

No, Medicare Part A does not require that you choose a primary care doctor.

In most cases, you do not need a referral to see a specialist – but the specialist must be enrolled in Medicare.