Medicare Part C: Medicare Advantage

Medicare Part C (otherwise referred to as Medicare Advantage) plans are offered through private insurance companies and they combine:

- all the benefits of Part A

- all the benefits of Part B

- prescription drug coverage (Part D) is included in many Part C plans

- plus additional benefits and built-in programs

So Medicare Advantage plans provide help with the medical services that you get with Original Medicare (Parts A &B), plus many Medicare Advantage plans also include prescription drug coverage. They also often have additional benefits and built-in programs bundled with the plan, for example: vision, hearing, dental, fitness programs, etc.

It is important to understand that these plans typically have low or no monthly premiums. Meaning, you do not have to pay an additional premium upfront each month to have the policy in place. Instead, there are fixed co-payments for services and you ‘pay as you go’.

Remember: you must always continue to pay your Medicare Part B premium.

How Much Does Part C Cost?

Medicare Part C plans can vary in monthly premium amount, depending on which plan you choose. However, many Medicare Advantage plans have no monthly premium. This is possible because Medicare Advantage insurance companies are provided a monthly stipend from Medicare. That stipend is then used to subsidize the zero-premium plans.

In other words, Medicare pays the insurance company to administer your benefits. So instead of the federal government (Medicare) managing your health care, a private insurance company of your choice is doing that instead. Medicare has paid that insurance company a monthly amount to take care of you. Therefore, they can charge no premium because they are getting paid by the government.

What Does Part C Cover?

Medicare Part C plans provide help with the following:

- all the benefits of Part A (hospital stays, skilled nursing, home health care) – except hospice care

- all the benefits of Part B (doctor visits, outpatient care, screenings and shots, lab tests, etc.)

- prescription drug coverage is included in many Medicare Advantage plans

- extras benefits that may be bundled with the plan include: eye care, hearing care, dental care, nurse helpline, etc.

These are examples of the most common items Part C plans will help with. For a comprehensive list, see your plan’s specific benefits.

How Do I Sign Up for Part C?

Each private company that offers Medicare Advantage plans has its own enrollment process. When you’re ready to join, we will help you expedite that enrollment process – at no cost to you.

When Can I Sign Up for Part C?

To sign up for a Medicare Advantage plan, you must:

- be enrolled in Medicare Part A and Part B

- permanently live in the Medicare Advantage plan’s service area (based on county)

- not have End-Stage Renal Disease

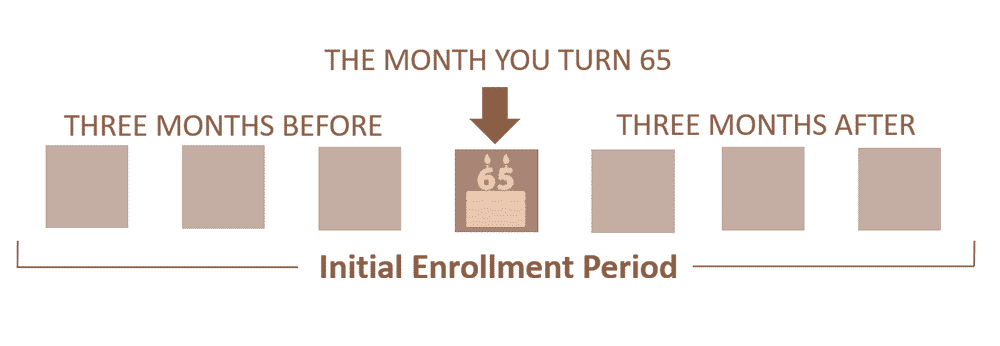

Initial Enrollment Period

The 3 months before your 65th birthday, the month of, and the 3 months after

IEP: Initial Enrollment Period

Your initial enrollment period (IEP) begins 3 months before, the month of, and ends 3 months after the month of your 65th birthday (giving you a 7-month window). You can choose any type of Medicare Advantage plan during the IEP.

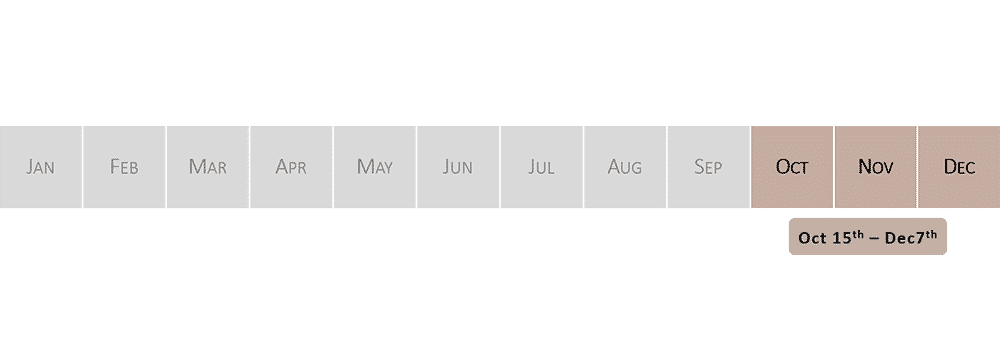

Annual Enrollment Period

Every year between October 15 – December 7

AEP: Annual Enrollment Period

Each year during the annual enrollment period (AEP) you can join or change a Medicare Advantage plan. AEP runs from October 15 – December 7 of every year.

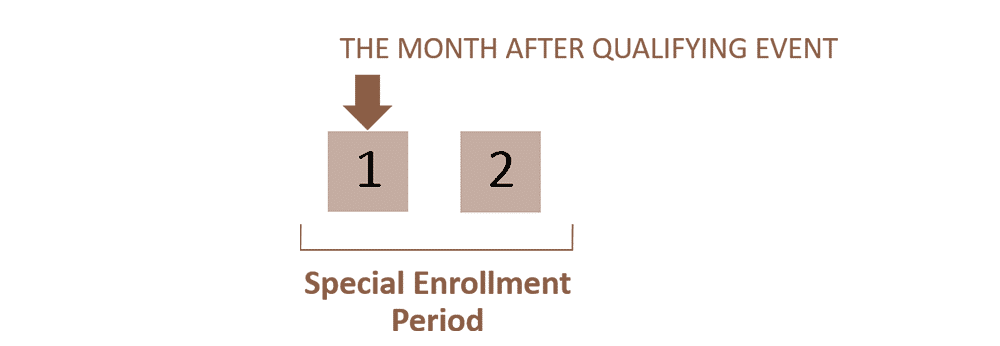

Special Enrollment Period

Typically 60 days to enroll in Part C

SEP: Special Enrollment Period

A special enrollment period (SEP) allows you to enroll in a Medicare Advantage plan outside of IEP or AEP if certain specific circumstances apply to you. For example if you:

- permanently move out of the plan’s service area

- voluntarily or involuntarily lose employer group coverage

- enter, reside in, or leave a long-term care facility

- are eligible for both Medicare and Medicaid

- other exceptional circumstances

Which Doctors Can I See?

There are several types of Medicare Advantage plans to choose from. In some plans, your health care is “coordinated.” That means the plan coordinates your coverage through a primary care physician who manages the care you receive from specialists and hospitals. You may have to choose specific doctors and hospitals from within a network.

In other plans, you can get care from any Medicare-eligible provider who accepts the terms, conditions and payment rates of the plan before providing coverage. Doctors and hospitals can decide whether or not to accept those terms, conditions and payment rates each time they furnish covered services.

Plans available under the Medicare Advantage program include the following:

- Health Maintenance Organization plans (HMO)

- Preferred Provider Organization plans (PPO)

- Private Fee-For-Service plans (PFFS)

- Special Needs Plans (SNP)

Below we explain the main differences between these types.

HMO: Health Maintenance Organization

Health maintenance organization (HMO) plans have a defined network of providers that members must use for all scheduled care. Meaning, there is no coverage for out-of-network care – except in urgent care and emergency situations. These plans may require their members to choose a primary care physician and referrals are typically needed for specialist visits.

PPO: Preferred Provider Organization

Preferred provider organization (PPO) plans also have a defined network of providers, but members have the flexibility to see doctors inside or outside of that network. If members seek care outside of the network, their cost share is typically higher. These plans do not require their members to choose a primary care physician and referrals are not needed for specialist visits.

PFFS: Private Fee-For-Service

Private fee-for-service (PFFS) plans are similar to Original Medicare, except that they are offered by private companies (instead of the federal government). They allow members to receive care from any Medicare-approved provider that is willing to accept the terms of the plan’s payment schedule and agrees to treat the individual. However, the private insurance company negotiates with doctors and providers to determine how much the plan will pay and what members must pay for the services they receive.

SNP: Special Needs Plans

Special needs plans (SNP) are limited only to specific groups of people. For example:

- people eligible for both Medicare and Medicaid

- people with specific chronic or disabling conditions

- people who live in certain institutions

These plans typically require their members to choose a primary care physician and in most cases seek referrals to see a specialist. All SNPs must also provide prescription drug coverage (Part D).

Are Prescription Drugs Covered Under Part C?

Yes, many Medicare Advantage plans include prescription drug coverage.

Do I Need a Primary Care Doctor or a Referral to See a Specialist With Part C?

If you enroll in a Medicare Advantage HMO plan: yes, you may be required to select a primary care doctor and referrals are typically needed for specialist visits.

If you enroll in a Medicare Advantage PPO plan: no, you are not required to select a primary care doctor and referrals are typically not needed for specialist visits.

What are Maximum Out-of-Pocket Limits Under Part C?

All Medicare Advantage plans offer a maximum-out-of-pocket limit, which is a feature that caps your out-of-pocket spending for cost-sharing like deductibles, co-payments, and co-insurance. This built-in financial safety net assures you will never pay more than a certain amount (varies by plan) in any given plan year for covered medical services. Original Medicare does not offer this feature.

With Part A and Part B, there are no limits on your out-of-pocket spending for cost-sharing. In some situations (like long hospital stays) your coverage under Part A ends entirely, and you become responsible for paying all of your own costs.