Medicare Part B Medical Insurance

Medicare Part B is sometimes referred to as ‘medical insurance’ and provides help with the cost of outpatient services, such as:

- doctor office visits

- laboratory services

- ambulance fees

- diagnostic services (x-rays, MRIs, CT scans, EKGs, etc.)

For most people, Medicare Part B comes with a monthly premium which is often automatically deducted from your Social Security check each month. The Part B premium is calculated based on your income. You may also be subject to a penalty if you do not enroll in Part B when you are first eligible.

However, Part B does not cover all of your medical costs – as there are exclusions and out-of-pocket costs you are responsible for (i.e. medical deductible and coinsurance).

How Much Does Part B Cost?

Medicare Part B has a standard monthly premium, which is $134 in 2017. However, many people who get Social Security benefits pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits. Therefore, if you pay your Part B premium through your monthly Social Security benefit, you will pay less. Social Security will tell you the exact amount you will pay for Part B in 2017.

You will pay the standard Part B premium amount if:

- You enroll in Part B for the first time in 2017

- You do not get Social Security benefits

- You are directly billed for your Part B premium

- You have Medicare and Medicaid, and Medicaid pays your premiums

- Your modified adjusted gross income as reported on your tax return from 2 years ago is above a certain amount

Note: if your modified adjusted gross income is above a certain amount, you may pay more than the standard Part B premium. This is referred to as an Income Related Monthly Adjustment Amount (IRMAA).

What Does Part B Cover?

Medicare Part B covers two types of services: medically necessary services and preventive services. Medically necessary services are needed to diagnose or treat your medical condition and meet accepted standards of medical practice. Preventive services help to prevent or detect illness at an early stage, when treatment is most likely to work best.

Medicare Part B provides help with the following:

- doctor visits

- ambulance services

- outpatient medical services

- preventive care

- clinical laboratory services (blood tests, urinalysis, etc.)

- x-rays, MRIs, CT scans, EKGs, and some other diagnostic tests

- some diagnostic screenings, like colorectal and prostate cancer screenings and mammograms

- durable medical equipment for use at home (oxygen, wheelchairs, walkers, etc.)

- emergency room services

How Do I Sign Up for Part B?

If you are receiving Social Security benefits when you turn 65 or otherwise become eligible for Medicare, you should automatically be enrolled in Parts A and B. It is always best to check with your local Social Security office if you suspect there is a problem. If you don’t want to join Part B, you can refuse Part B coverage by going to your local Social Security office.

If you are not receiving Social Security benefits when you turn 65 or otherwise become eligible for Medicare, you can sign up for Part B at your local Social Security office or online.

Click here to find your local Social Security office

Click here for the Medicare Part B application

When Can I Sign Up for Part B?

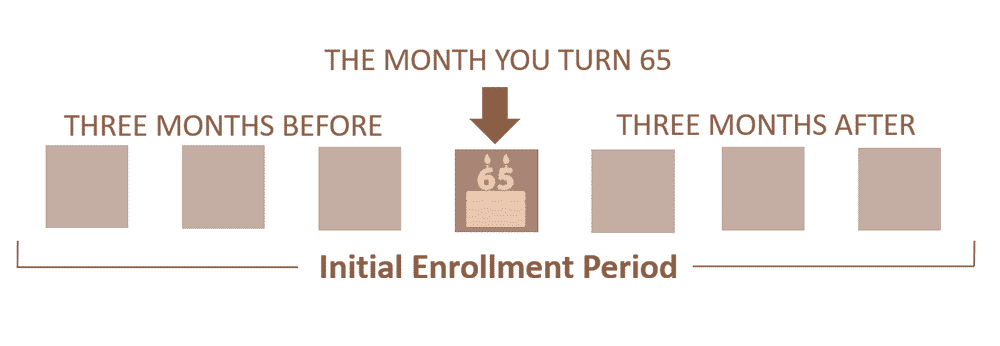

Initial Enrollment Period

The 3 months before your 65th birthday, the month of, and the 3 months after

IEP: Initial Enrollment Period

Your initial enrollment period (IEP) is your first chance to enroll in Medicare Part B. IEP includes the 3 months before, the month of, and the 3 months after the month of your 65th birthday (giving you a 7-month window).

- If you enroll before the month you turn 65, coverage starts on the first day of your birthday month.

- If you enroll during your birthday month or later, coverage starts on the first day of the month following the date you enroll.

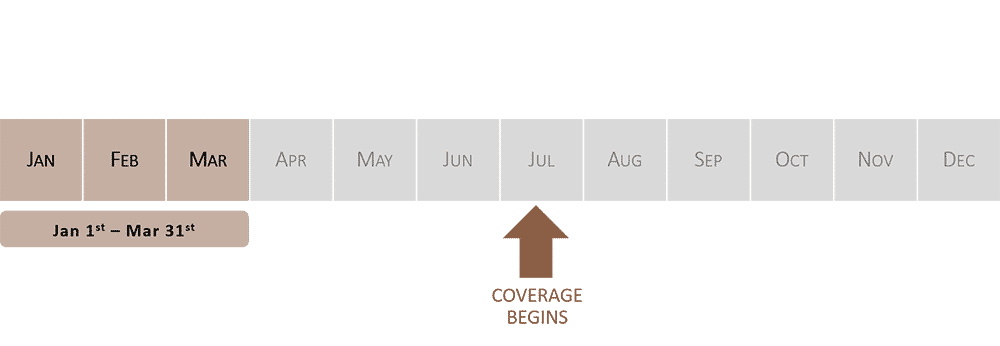

General Enrollment Period

Every year between January 1 – March 31

GEP: General Enrollment Period

If you do not sign up for Medicare Part B during your IEP, you will need to wait for the general enrollment period (GEP), which occurs every year from January 1 – March 31. During this time you may enroll in Medicare Part B and coverage will take effect July 1.

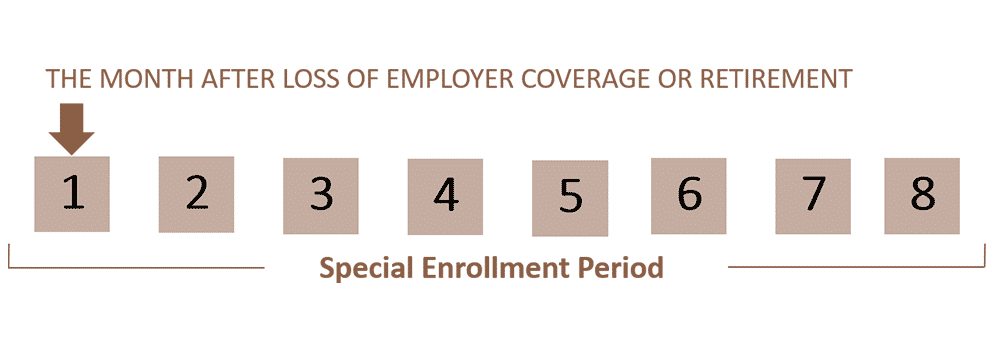

Special Enrollment Period

Up to 8 months to enroll in Part B

SEP: Special Enrollment Period

A special enrollment period (SEP) allows you to enroll in Medicare Part B outside of IEP or GEP if certain specific circumstances apply to you. For example: if you were working past age 65 and were covered on an employer or union group plan, then later lost that coverage due to retirement or loss of employment. During a SEP you are given an 8-month window (beginning with loss of employer group coverage) in which you can enroll in Medicare Part B.

Note: You may be subject to a penalty if you don’t sign up for Part B when you are first eligible. Your cost for Part B may go up 10% for each full 12-month period that you could have had Part B but didn’t sign up for it. You will pay that penalty for as long as you’re enrolled in Part B. This penalty may not apply to you if you are still working for an employer who provides group health coverage when you become eligible for Medicare.

Which Doctors Can I See?

You can choose any doctor or provider in the United States who accepts Medicare. Since Part B offers the same benefits throughout the United States, you are not limited to a particular state or region for your care.

Are Prescription Drugs Covered Under Part B?

With a few exceptions, most prescriptions are not covered by Medicare Part B. You can add drug coverage by enrolling in either a Medicare Advantage Plan (Part C) or a Medicare Prescription Drug Plan (Part D).Do I Need a Primary Care Doctor or a Referral to See a Specialist With Part B?

No, Medicare Part B does not require that you choose a primary care doctor.

In most cases, you do not need a referral to see a specialist – but the specialist must be enrolled in Medicare.

What is the Late Enrollment Penalty for Part B?

You may be subject to a penalty if you don’t sign up for Part B when you are first eligible. Your cost for Part B may go up 10% for each full 12-month period that you could have had Part B but didn’t sign up for it. You will pay that penalty for as long as you’re enrolled in Part B.

This penalty may not apply to you if you are still working for an employer who provides group health coverage when you become eligible for Medicare.