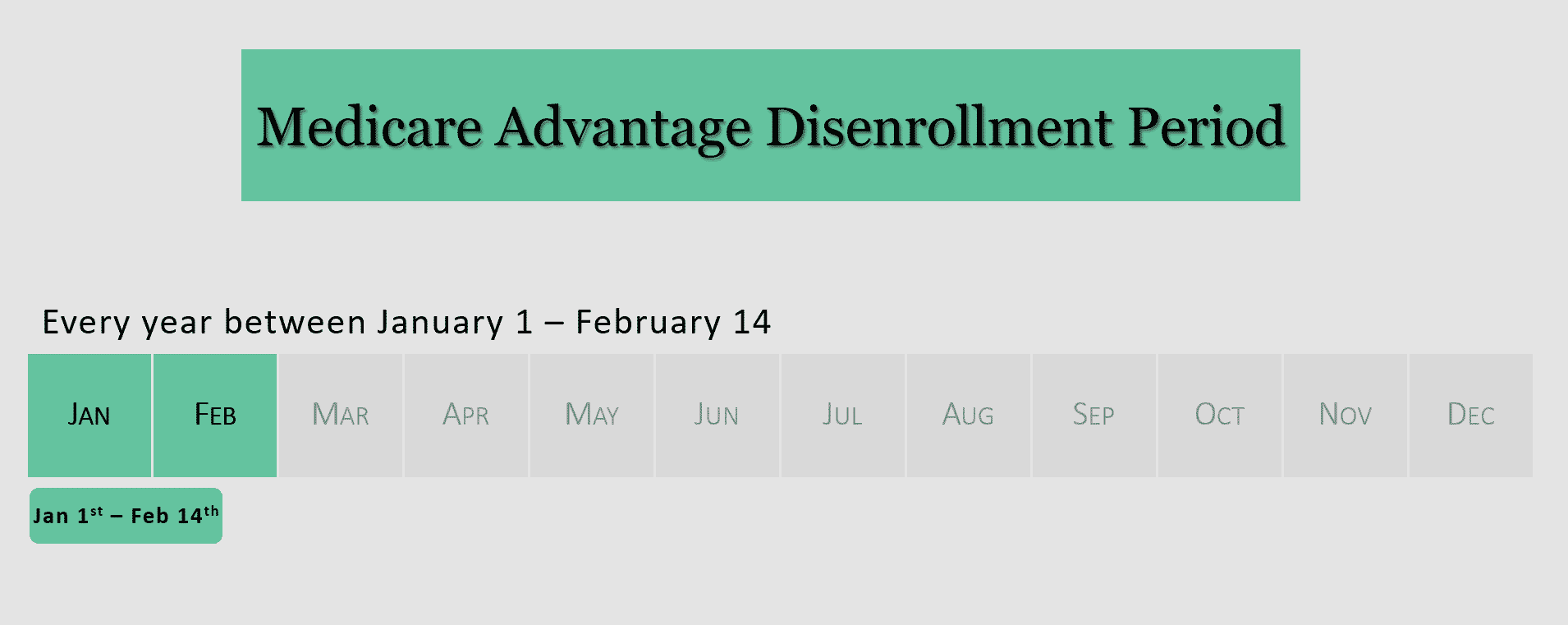

Are you unhappy with the Medicare Advantage plan you chose during Medicare Open Enrollment or think you may have chosen the wrong Medicare plan? If so, you have between January 1st and February 14th to drop out of your Medicare Advantage plan and go back to Original Medicare (Parts A and B).

Depending on your situation, there may be a way to address the issue if your Medicare plan isn’t looking so good this year. Below are some examples of why you might consider utilizing the Medicare Advantage Disenrollment Period.

- You changed to a Medicare Advantage plan that you don’t like.

Don’t like your new Medicare Advantage plan? You can drop out of your new plan during the Medicare Advantage Disenrollment Period from January 1 through February 14. However, you cannot change to another Medicare Advantage plan during this time. Instead, your coverage will go back to Original Medicare (Parts A and B). You can also add a Medicare Part D (prescription drug) plan during this time, if the Medicare Advantage plan you’re leaving included prescription drug coverage. You have until February 14 to do so.

You might be able to also add a Medicare Supplement (Medigap) plan to help with the costs that Original Medicare does not cover. Medigap plans have a continuous enrollment year-round, so you are not restricted to a specific period of time to enroll.

If you miss the February 14 Medicare Advantage Disenrollment Period deadline, you’ll have to wait until the next Open Enrollment Period to make changes to your plan. Medicare Open Enrollment run from October 15 through December 7 of every year.

- Your doctor does not accept your Medicare Advantage plan.

Whether this is your first time joining a Medicare Advantage plan or you recently changed from one Medicare Advantage plan to another, it is very important to have coverage that includes all of your doctors. If you find out that your doctor doesn’t take your plan, you can drop your Medicare Advantage plan and revert back to Original Medicare during the Medicare Advantage Disenrollment Period.

Before leaving your Medicare Advantage plan, it might be useful to call the plan to speak to someone about their physician groups. It is possible that your plan has not asked your physician group to join their network. Therefore, it’s worth finding out whether your current doctor is willing to join your plan’s coverage network before making a final decision.

- Your prescriptions are no longer covered or are much more expensive.

Your pharmacy might tell you that your new plan doesn’t cover one of your important medications or it covers all your medications, but the co-pays are much higher than last year. Before changing your plan, you can try taking the list of covered drugs to your doctor and asking if they can help find an alternative medicine that is covered by your plan that will still work for you.

If one or more of your medications are still prohibitively expensive, you can try asking your doctor if they have samples you can use or if they know of a pharmaceutical assistance program through the drug manufacturer that will allow you to purchase the medication at a reduced rate. Your doctor can also request a formulary exception on your behalf if you need a medication that is not covered by your plan.

If none of the above fits your situation, you can drop your Medicare Advantage plan during the disenrollment period. Your coverage would go back to Original Medicare and you could add a stand-alone prescription drug plan that better suits your needs.

Picking the right Medicare plan can be incredibly complicated, and many people run into problems they didn’t anticipate. Medicare Advantage and prescription drug plans can and do change from year to year which is why it is so important to review any changes during Medicare Open Enrollment to ensure you are still on the right plan for your needs. Things like premium, rules for cost-sharing, and coverage of specific medications are all points of concern. You should also evaluate your plan’s network of doctors and pharmacies to ensure your doctor(s) and local pharmacies are still within the plan’s network. If there are significant changes to your policy, the open enrollment period is the time when you can change to a different plan that better suits your needs.

Many people, however, are not aware of the changes to their plan and miss the opportunity to switch coverage during Open Enrollment. If this happens to you, the Medicare Advantage Disenrollment Period might be an option to consider utilizing. The important thing is to address your concerns immediately. Getting accurate information about what you can and cannot do, and what costs might arise for you in the future is critical to making an informed decision about your next steps.